V/A Vucovich & Associates

Vucovich & Associates

Phone:

- 334-239-9110

- E-mail address: christopher.vucovich@equitable.com

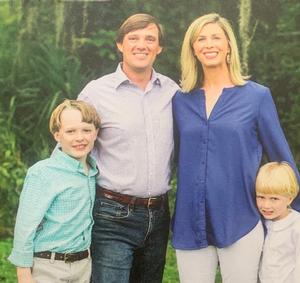

Christopher Vucovich

Securities offered through Equitable Advisors, LLC (NY,NY 212-314-4600), member FINRA/SIPC(Equitable Financial Advisors in MI & TN). Annuity and insurance products offered through Equitable Network, LLC, which conducts business in CA as Equitable Network Insurance Agency of California, LLC, in UT, as Equitable Network Insurance Agency of Utah, LLC, and in PR as Equitable Network of Puerto Rico, Inc. Equitable Advisors and its affiliates do not provide tax or legal advice. Please consult your tax and legal advisors regarding your particular circumstances. Individuals may transact business, which includes offering products and services and/or responding to inquiries, only in state(s) in which they are properly registered and/or licensed. The information in this web site is not investment or securities advice and does not constitute an offer.

Vucovich & Associates is not a registered investment advisor and is not owned or operated by Equitable Advisors or Equitable Network.

For more information about Equitable Advisors, LLC you may visit equitable.com/crs to review the firm’s Relationship Summary for Retail Investors and General Conflicts of Interest Disclosure. Equitable Advisors and Equitable Network are brand names for Equitable Advisors, LLC and Equitable Network, LLC, respectively.

Link to equitable.com